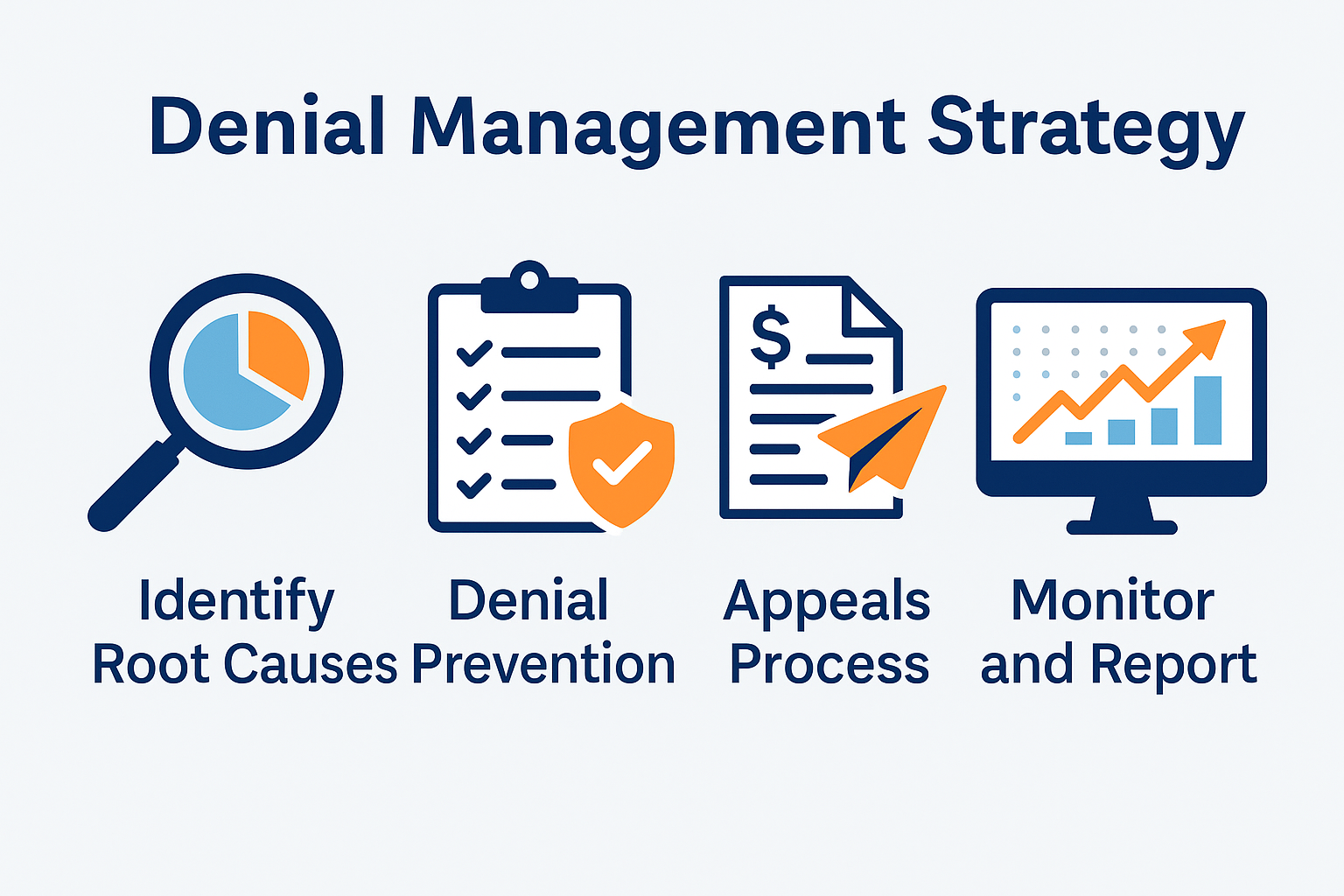

Introduction: Why Denials Management Defines Financial Performance

In healthcare revenue cycle management, few metrics impact cash flow as directly as denial rate. Every denied claim delays revenue, increases labor cost, and creates administrative friction. Yet many organizations still treat denials as an inevitable part of billing. In reality, a robust denials management strategy transforms denial prevention, tracking, and resolution into a measurable engine of financial control.

The Financial Impact of Denials

According to the Healthcare Financial Management Association (HFMA), up to 10 % of all claims are denied, and over 60 % of those are never resubmitted. The average cost to rework a denied claim can range from $25 to $118, excluding lost revenue. For hospitals or medical groups processing thousands of claims each month, denials can erode annual revenue by millions.

A strategic denials management framework reduces these losses by attacking root causes, improving first-pass resolution, and fostering accountability across the entire revenue cycle.

Step 1: Identify and Categorize Root Causes

Effective denial management begins with classification. Each denial should be tagged by root cause, not just denial code. Common categories include:

- Front-End Errors: Incorrect patient demographics, eligibility, or authorization.

- Coding and Charge Capture: Missing modifiers, unbundled codes, or incorrect CPT/ICD assignments.

- Payer Policy Issues: Contract terms, bundling rules, or medical necessity denials.

- Timely Filing or Documentation Delays: Late submissions or missing clinical notes.

Once categorized, data analytics should reveal the top three to five drivers of denials. Dashboards that visualize trends by payer, location, or service line help executives pinpoint where interventions will deliver the greatest impact.

Step 2: Establish Denial Prevention Protocols

Prevention is more effective than appeal. The most successful RCM organizations focus on first-pass resolution rather than post-denial cleanup.

Core prevention tactics include:

- Eligibility Verification: Automate checks before the date of service.

- Pre-Authorization Management: Integrate prior authorization tracking into scheduling workflows.

- Real-Time Edits: Use claim-scrubbing software that enforces payer-specific rules and stops defective claims before submission.

- Front-Office Training: Cross-train staff on insurance updates, referral requirements, and documentation standards.

When denial prevention becomes a front-line KPI, denial volume can drop by 25–40 % within months.

Step 3: Streamline the Appeals Process

Even with strong prevention, some denials are unavoidable. An optimized appeals process ensures no collectible dollar is left behind.

Key elements include:

- Standardized Appeal Templates: Reduce turnaround time and improve consistency.

- Evidence-Based Justification: Cite payer guidelines and medical policy references.

- Appeal Timelines Dashboard: Track pending appeals and escalate those nearing deadline.

- Workflow Automation: Use RPA (robotic process automation) bots to retrieve EOBs and update claim status automatically.

RCM teams should also maintain a denial appeal win rate metric to measure effectiveness—ideally above 70 % for technical denials.

Step 4: Build Cross-Functional Accountability

Denials management is not a billing problem—it’s an enterprise accountability issue. Establish recurring cross-functional reviews with representation from front-office, clinical, coding, and finance.

Use these sessions to review:

- Top denial categories

- Payer performance variances

- Preventable vs. non-preventable denials

- Root-cause action plans

Executives should embed denial reduction goals into department scorecards, aligning financial outcomes with operational ownership.

Step 5: Monitor and Report Key Metrics

A modern denial management strategy requires continuous measurement.

Essential KPIs include:

- Denial Rate: ≤ 4 % of total claims

- First-Pass Resolution Rate: ≥ 95 %

- Appeal Success Rate: ≥ 70 %

- Average Days to Resolve Denials: ≤ 15 days

- Cost to Rework Claim: ≤ $25

Visualizing these metrics in real-time dashboards allows leadership to make data-driven adjustments and sustain results.

Technology’s Role in Denials Management

AI-driven analytics now allow healthcare organizations to predict denials before submission. Machine learning models can identify high-risk claims and flag them for preemptive review. Natural language processing (NLP) tools extract reasons for denials from payer correspondence automatically, eliminating manual logging.

Cloud-based RCM systems also centralize denial data from multiple payers, improving transparency and collaboration across billing teams.

Creating a Culture of Denial Prevention

Ultimately, the strongest denial management programs are cultural as much as technical. When every stakeholder understands how their actions affect reimbursement, accountability becomes self-sustaining.

- Front-desk staff ensure demographic accuracy.

- Clinicians complete documentation promptly.

- Coders adhere to payer-specific policies.

- Billing teams monitor edits and trends.

When leadership reinforces these connections with regular communication and recognition, denial rates naturally decline and cash flow stabilizes.

Conclusion: Turning Denials into Strategic Advantage

Denials will always exist, but unmanaged denials don’t have to. A well-designed denials management strategy reduces administrative waste, improves collection velocity, and drives stronger margins. By combining analytics, automation, and accountability, healthcare executives can turn denials from a recurring headache into a measurable performance opportunity—positioning their organizations for sustained financial strength in an increasingly complex reimbursement landscape.